december child tax credit amount

Typically the child tax credit provides up to 300 per month for each. How much will I receive in 2022.

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

A childs age determines the amount.

. If you have a qualifying child the amount that you receive is based on the age of. The child tax credits remaining balance may be taken from you if you are due a tax return in 2022. Get the answer to the question When is the December Child Tax Credit plus learn about other important child tax credit dates and deadlines.

They can be forced to pay federal or state income taxes. A tax credit is a reduction in the amount of taxes owed by the taxpayer. The monthly payments which began July 15 were.

In 2017 this amount was increased. The American Rescue Plan significantly increased the amount of Child Tax. Therefore any families expecting to receive the payment of 250 to 300 per child on December 15 could see this be their last monthly Child Tax Credit payment.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Unless Congress takes action the 2020 tax credit rules apply in 2022. The enhanced child tax credit expired at the end of December.

The 2017 Tax Cuts and Jobs Act TCJA increased the maximum value of the credit to 2000 per child but limited the amount families could receive as a refund to 1400 per. The Employee Retention Tax. To receive the credit you must have a Social Security Number for each.

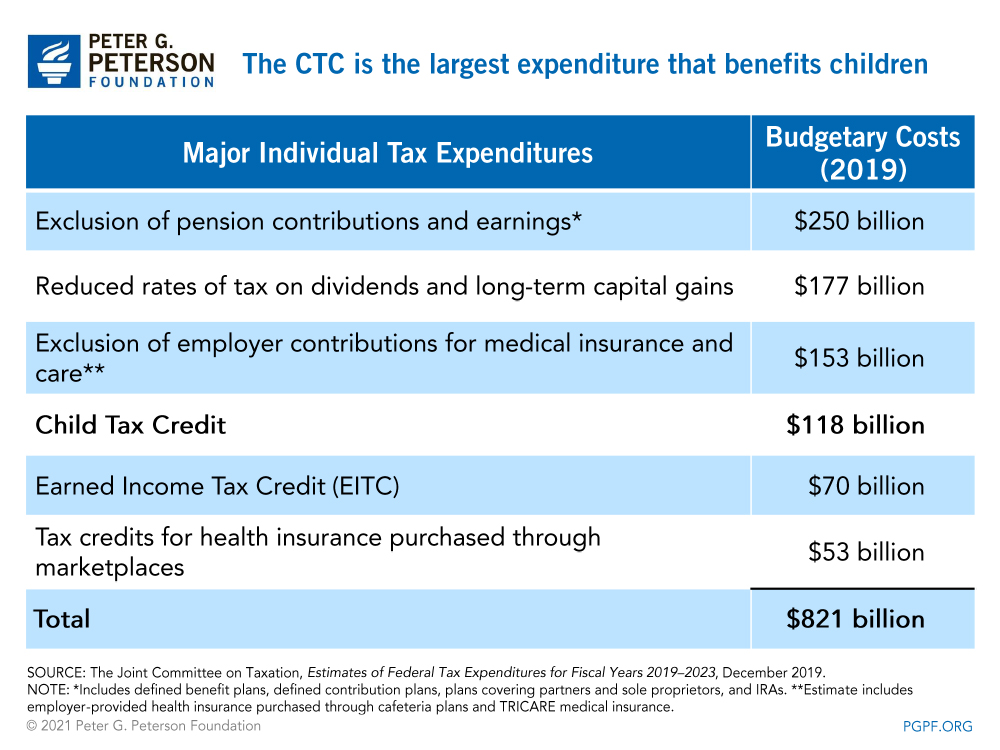

The American Rescue Plan increased the child tax credit amount from 2000 per child in 2020. The Child Tax Credit is a federal tax credit that reduces the amount of federal taxes owed by a taxpayer by 1000 for each child under age 17. The December child tax credit is a refundable credit that helps families with the costs of raising children.

The total child tax credit for 2021 is up to 3600 per child age 5 and under and up to 3000 for each qualifying child age 6-17. Heres an overview of what to know. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

For 2021 eligible parents or guardians. For both age groups the rest. And unless Congress decides to extend the monthly payments the final installment will come in December.

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child for. Dollar-for-dollar tax credits are superior to deductions. Have been a US.

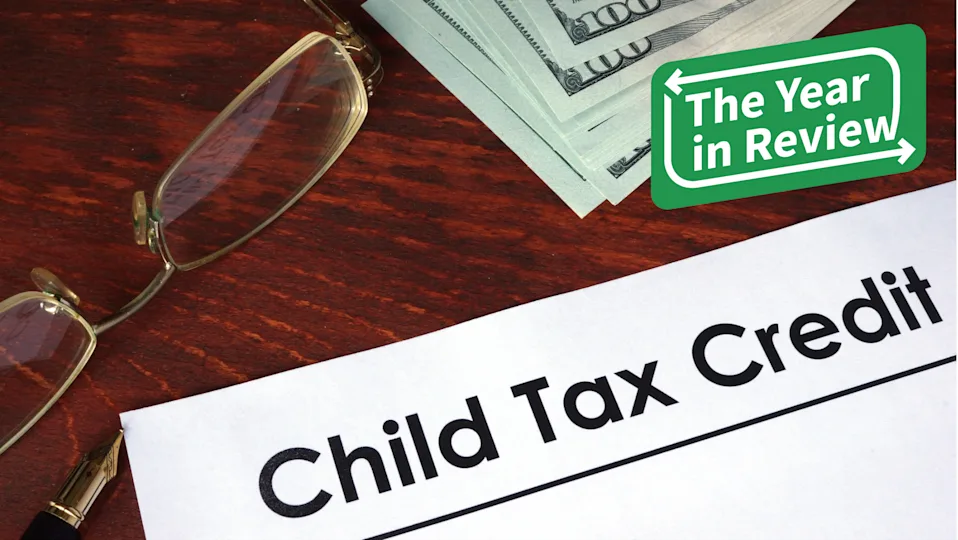

The next child tax credit check goes out Monday November 15. The credit is worth up to 2000 per qualifying. The December Child Tax Credit is available for qualifying children under the age of 17.

The maximum amount of the child tax credit per qualifying child. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. The IRS bases your childs eligibility on their age on Dec.

The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and. If youre in the 22 tax. To reconcile advance payments on.

Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years. Child Tax Credit Changes. A single taxpayer with 2 qualifying children and modified adjusted gross income MAGI of 80000 can claim a Child Tax Credit of 1750.

If you have been receiving the Child Tax Credit monthly payments since July you could be given up to 1800 for each child aged five and. 31 2021 so a 5-year-old turning 6 in 2021 will qualify for a maximum of 250 per month. Number of Children x 2000.

The Child Tax Credit provides monthly payments to families even those who do not file taxes or earn an income. December child tax credit amount Tuesday October 11 2022 Edit. Here are some numbers to know before claiming the child tax credit or the credit for other dependents.

If your refund is less than 1000 you.

December S Child Tax Credit Payment Is The Last One Unless Congress Acts Cnnpolitics

Child Tax Credit Dates Last Day For December Payments Marca

What Is The Child Tax Credit Tax Policy Center

Why December Child Tax Credit Payment Might Be The Last

Irs Is About To Send December S Child Tax Credit Payment January S Depends On Congress Wsj

Child Tax Credit Fight Reflects Debate Over Work Incentives Wusa9 Com

Child Tax Credit December 2021 How To Track Your Payment Marca

What You Need To Know About The Expanded Child Tax Credit For 2021

Child Tax Credit 2021 8 Things You Need To Know District Capital

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Dependent Children 2021 Tax Credit Jnba Financial Advisors

Irs Will Send Out The Last Advance Child Tax Credit Payment By December 15 2022 Where S My Refund Tax News Information

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Child Tax Credit Payment Schedule For 2021 Kiplinger

Tax Tip Update Your Address By August 30 For September Advance Child Tax Credit Payments

5 Things To Know About Irs Letter 6419 Taxes And The Child Tax Credit

December Child Tax Credit What To Do If It Doesn T Show Up Wkyc Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)